Imagine transferring $30,000 to your mom without using a bank. Instead, you call up a broker to who you will give the money.

Said broker then calls another broker where your mom lives and tells them that you are transferring $30,000, and in order for your mom to retrieve the money, she must give the second broker a secret password. There is no formal documentation, no promissory note, no security, just trust and the belief that your money is safe and will end up where it is intended to go.

That sounds crazy and like a recipe to be a fraud victim, doesn’t it? Well, this method of transferring money is not as crazy as it sounds. In fact, the hawala system, as it is known, has been used since ancient times and is still used to this day.

Hawala

Hawala is an informal transfer system for money. The hawala system revolves around the honor and performance of international money brokers, called hawaladars. The hawala system operates parallel to and outside of traditional banking, traditional banking systems, and remittance.

Remittance is the transfer of money by someone who works in a foreign country, is a member of the diaspora, or is a citizen with familial ties abroad in order to cover household income in their homeland. Remittance is simply sending all or a majority of your earned income back home to support your family and is a common practice in areas where joint families are the norm.

Hawala was first created by Muslim, Indian, and Arabic traders in the 8th century. The reason this system of passing money from one hawaladar to another was devised as a way to protect the traders from being victims of theft.

Hawala was the primary form in which money transfers were carried out in India before the country’s banking systems were modernized. There are several reasons why an individual would choose to use hawala, such as:

- It is easy to use. Hawaladars can often be found in common and convenient locations like small shops and markets, which makes it easy for individuals to use their services.

- It is low cost. Compared to the fees charged for transferring money through traditional Financial Institutions, hawala fees are incredibly low. The low cost is an enormous appeal for people who need to transfer small amounts of money.

- It is fast. Hawala money transfers and transactions are able to be completed quickly. The speed is convenient for individuals who must transfer money with little to no notice.

- It is discrete. Hawala transactions are not documented in official records the way traditional Financial Institutions record everything. The system provides a level of security and privacy that standard banks cannot. Some people like to keep their financial actions private, and hawala allows someone to do it easily.

- The Great Stock Exchange Fraud: Lord Cochrane’s Napoleonic Lies?

- Murder of Banker Roberto Calvi: Vatican, Mafia, or Secret Society?

How It Works

The way that the standard hawala system work is explored below:

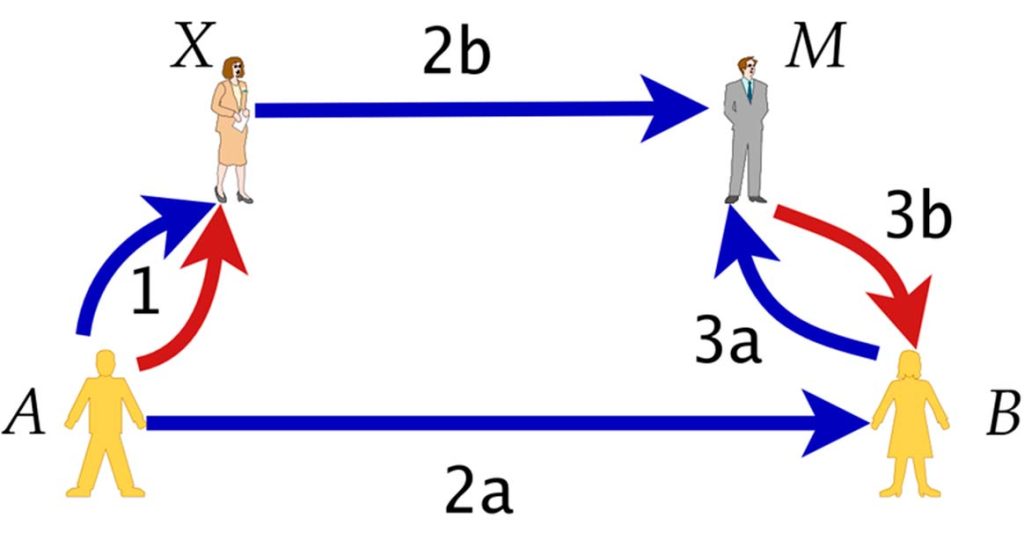

A sender or a client will approach a hawaladar and ask them to transfer money to a beneficiary or recipient in another location. The hawaladar and the sender then establish a password or code that is used to identify the transaction.

The sender provides the hawaladar with the amount of money they wish to be transferred, plus a fee for the services of the hawaladar. Typically the fee is based on a percentage of the total cash value being transferred.

The hawaladar will then contact another hawaladar colleague in the recipient’s location and will provide the details of the transaction as well as the required password or code. This second hawaladar in the recipient’s location will receive the password or code from the recipient, and the agreed-upon money will be given. The hawaladars themselves will settle their “accounts at a later date, either through the transfer of funds or by balancing their accounts with other transactions.”

What makes the hawala system unique is that it does not include promissory notes that would be exchanged between the dealers. The honor system regulates transactions. “As the system does not depend on legal enforceability claims, it can operate even in the absence of a legal or juridical environment.”

If a hawaladar steals their client’s money, they are harshly punished and lose their honor. They can be excommunicated and lose their business leading to poverty. Individual transactions may be informally recorded, or a running tally of one hawaladar owes another is kept.

Settling the debts among hawaladars can be completed by giving goods and services, properties, employees or staff, and do not need to be direct cash transactions. Giving another hawaladar your beach house or transferring your employees to them in an effort to settle a debt might sound strange and lead to questions about how the hawaladars make their money.

A hawaladar will receive a commission as well as gain profits by “bypassing official exchange rates. Generally, the funds enter the system in the source country’s currency and leave the system in the recipient country’s currency.”

Hawala and Crime

Because hawala systems are unregulated and not protected by law, there are several risks associated with this method of transferring money. The most significant and obvious risk is that fraud may occur.

While personal connections and trust make up the structure of the hawala system, the lack of formal records or documentation puts users at an increased risk for fraud. Some halawadars do not deliver the funds as they are expected to. Instead, they pocket the money for themselves.

Along the same lines as fraud, another risk of hawala can result in the loss of funds. If a mistake is made during the transfer process, there is no way to dispute the transaction due to the lack of formal records/restitution processes. If funds are lost, it might be impossible to recover them.

A third risk relates to the volatility of the funds. The value of the funds that are being transferred via hawala can be impacted by shifts in market conditions or exchange rates. This means a recipient could receive less than the original amount. The final risk that is associated with hawala is that it can facilitate illicit activities such as money laundering or financing terrorist organizations.

The informality of hawala means that some organizations and individuals can easily bypass financial sanctions and operate without being detected by authorities. It has been found that hawala was used to move funds to places like Iran, which is under international sanctions, and terrorist groups like Hamas.

Hawala has been used in financial scandals and in the facilitation of the illicit drug trade. In 2015 the US Department of the Treasury published a report that declared it had imposed sanctions on a network of companies and individuals based in Pakistan and Afghanistan because they were using the hawala system to support the sale of opium and other illicit drugs.

The individuals involved in the scandal were being accused of using hawala to transfer drug funds to the Taliban. Hawala and its reliance on personal connections and undocumented transfers make it easy for criminals to move money without detection.

Supporters of the hawala system believe there should be some form of regulation to protect innocent individuals from associations with terrorism and the drug market and provide a little protection from fraud. Whether a regulatory system of hawala is able to be established is uncertain, but that has not stopped developing countries and immigrants from using this centuries-old method to transfer money.

Top Image: The hawala system offers great convenience, but the lack of documentation has let to it being used by drug dealers and terrorists. Source: Fotokitas / Adobe Stock.